| 2 |  | www.walmart.com |

Table of Contents

Dear Fellow Shareholders:Messages from our Chairman and our

Lead Independent Director

We are pleased to invite you to attendjoin us for Walmart’s 20172020 Annual Shareholders’ Meeting on June 2, 20173, 2020 at 8:0010:30 a.m. Central Time. If you planDue to attend, please see page 102 for admission requirements. For those unablethe public health impact of the coronavirus (COVID-19), the 2020 Annual Shareholders’ Meeting will be a completely virtual meeting conducted via webcast. You will be able to join in-person, the meeting will also be webcast athttp://stock.walmart.com.

From Our Chairman

Fiscal 2017 was a year in which we saw the ongoing transformation of Walmart gain momentum. In a new era of disruptionparticipate in the retail industry, we continued to execute our strategy to become the first company to deliver a seamless shopping experience at scale, regardlessvirtual meeting online, vote your shares electronically, and submit questions by visitingwww.virtualshareholdermeeting.com/WMT2020.

Dear Fellow Shareholders: As I did in my letter last year, I’d like to highlight some ways we are driving Walmart’s ongoing transformation, guided by the four key components of our plan to win: | | Dear Fellow Shareholders: As I complete my second year as your Lead Independent Director, I want to emphasize your Board’s ongoing commitment to robust governance and oversight. Continued focus on Board effectiveness now and in the future.As Walmart’s strategy continues to evolve, so will the skills, qualifications, experiences, and backgrounds that the Board seeks in director nominees. Our 12-year term limits for independent directors promote a disciplined director refreshment process, while our robust board evaluation process provides insights into the needs of the Board in the future. We believe that this process has resulted in a diverse and highly skilled Board with the right mix of perspectives, experiences, and tenures to guide us through this period of rapid change, and to provide effective leadership as we continue to serve our communities while protecting our associates and customers during this current global health crisis. We value your feedback.This year marked the sixth year of our expanded shareholder engagement program, and since our last shareholders’ meeting, we invited shareholders representing approximately 570 million Shares, including many of our largest investors, to participate in our outreach program. We ultimately engaged with shareholders representing approximately 525 million Shares, or about 38% of our public float, to discuss strategy, governance, compensation, and sustainability, among other topics. These conversations have contributed to our governance best practices and have helped us continue to enhance our disclosures in this proxy statement to provide investors with the information they seek. Ensuring our compensation practices support our strategy.We are committed to ensuring that our compensation program continues to support our strategy during this period of rapid change. The Board’s Compensation and Management Development Committee regularly reviews the performance metrics used in our incentive plans to ensure that they promote strong operating results and investments that support our ongoing transformation. Over the past several years, the CMDC has introduced greater differentiation to reward high performance, shifted our pay mix to place a greater emphasis on equity ownership, and simplified our long-term incentive awards. You can learn more about our executive compensation program in the CD&A beginning on page 42. Thank you for your investment in Walmart. The Board continues to work to represent your interests and earn your trust. |

| Make every day easier for busy families; | |  | Sharpen our culture and become more digital; | |

| Operate with discipline; and | |  | Make trust a competitive advantage. | |

These areas of focus are fundamental in running our business every day, and even more so as Walmart plays an important role during the current global health crisis. Families need us more now than ever. Communities, customers and associates are counting on us. During this challenging time, we are keeping health and safety a priority by making our facilities safer for our associates to work and our customers and members to shop through actions such as increased sanitation, limiting the number of people in stores and clubs, and expanding no-contact pickup and delivery services. We appreciate the gravity of the responsibility we have, and we are grateful and proud of our associates doing extraordinary things to help communities across the globe. We made significant progress against each of the key components of our plan in fiscal 2020. We have continued to expand our U.S. omni-channel platform and now offer grocery pickup at approximately 3,200 locations and grocery delivery at 1,600 locations. We grew Walmart U.S. eCommerce sales by 37% with improved customer satisfaction. Outside of the U.S., we are expanding our ecosystems, with Flipkart and PhonePe scaling quickly in India and same-day delivery in key markets. We continue to innovate in the way we work by becoming more digital and working in small teams to drive innovation – and we’re continuing to invest in our associates’ pay, benefits, tools, and training. We are also finding new ways to leverage the scale and breadth of our operations, bringing technology to life to better serve our customers in a more seamless way. We are committed to earning the trust of our customers, communities, and other stakeholders. Your Board is highly engaged in overseeing our ongoing transformation. We are confident that the Board has the right mix of diverse skills, experiences, and backgrounds to serve as a strategic asset. We are also focused on thoughtful board refreshment, with term limits for independent directors and a robust director succession planning and recruitment process. I am confident your Board is well-positioned to continue to guide us in the years to come. Thank you for your continued support of Walmart, and I encourage you to attend our virtual shareholders’ meeting. Regardless of whether you are able to join us live for the 2020 Annual Shareholders’ Meeting, your views are important to us, and I encourage you to vote your Shares as described on page 102. | |

Sincerely,

Gregory B. Penner

Chairman | |  | | Sincerely,

Thomas W. Horton

Lead Independent Director |  |

Table of how our customers choose to shop with us.

One of our key priorities is to make life easier for busy families, and steps we took in fiscal 2017 – including our acquisition of Jet.com, our strategic alliance with JD.com in China, and our expansion of online grocery and marketplace – provide our customers with more ways to save time and money. Similarly, our significant investments in the wages, training, and opportunity of our U.S. associates have already resulted in a better shopping experience for our customers.

Your Board of Directors has been deeply engaged with, and partnered closely with management on, all of these key strategic decisions. Our majority-independent Board plays a vital role in overseeing our strategy and ongoing transformation, and I firmly believe that your Board, with its broad mix of experience, skills, and backgrounds, is a strategic asset for our company. We are committed to an independent and robust Board and to thoughtful and effective Board refreshment, and have added 7 new directors in the past 5 years. This year, we are excited to announce Carla Harris as a new director nominee. Carla brings deep experience in capital markets and global finance, and I’m confident she will be an asset to the Board and to Walmart.

In these exciting times, Walmart is uniquely positioned to make our customers’ lives easier and deliver sustainable growth in the future. Thank you for your continued support of Walmart, and I look forward to seeing many of you at the meeting in June. Regardless of whether you are able to attend the meeting in person, your vote is important to us. For instructions on how to vote, please see page 103 of this proxy statement.

From Our Lead Independent Director

As Walmart continues to adapt to serve our customers seamlessly – in stores, online, or through pickup or delivery – we are committed to continuously enhancing our Board governance to support our strategy. As described in this proxy statement, we’ve made important changes to the way the Board works to maximize our effectiveness during this period of change.

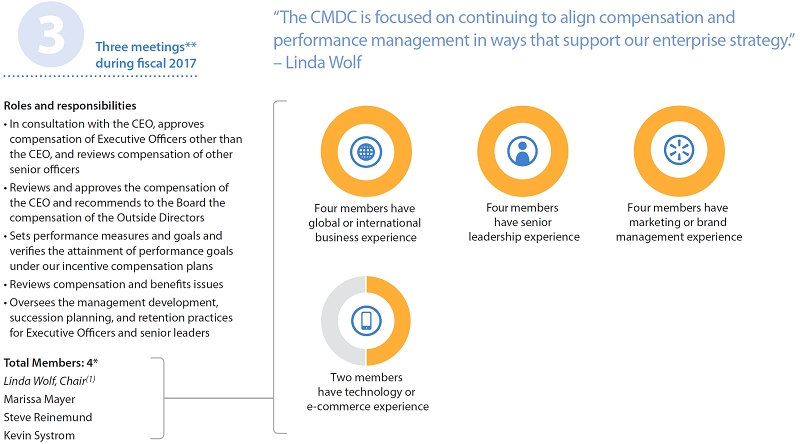

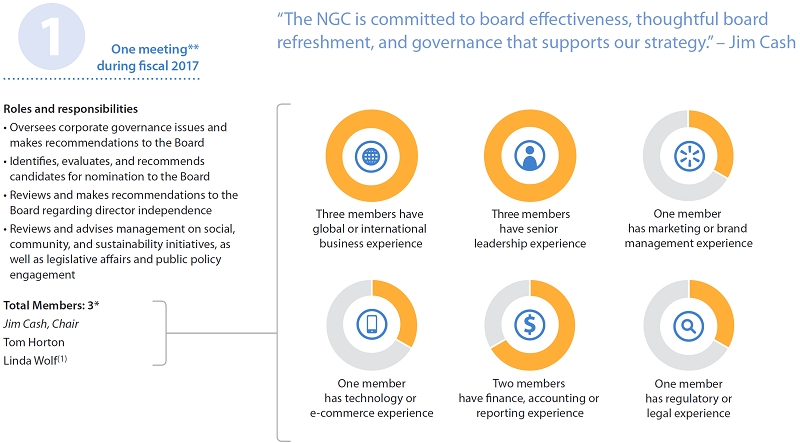

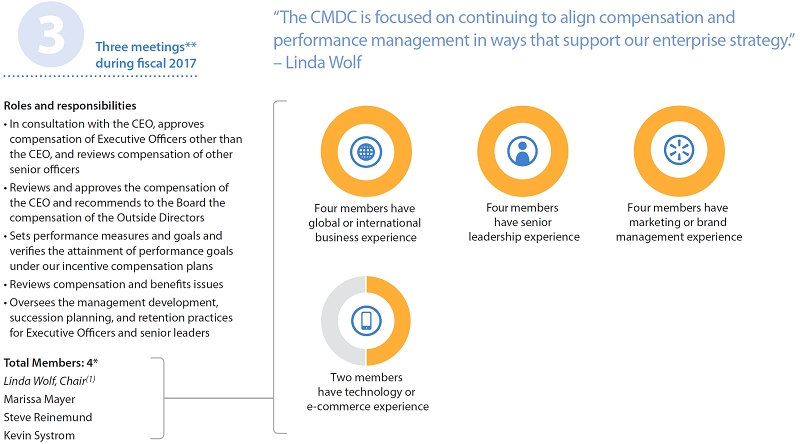

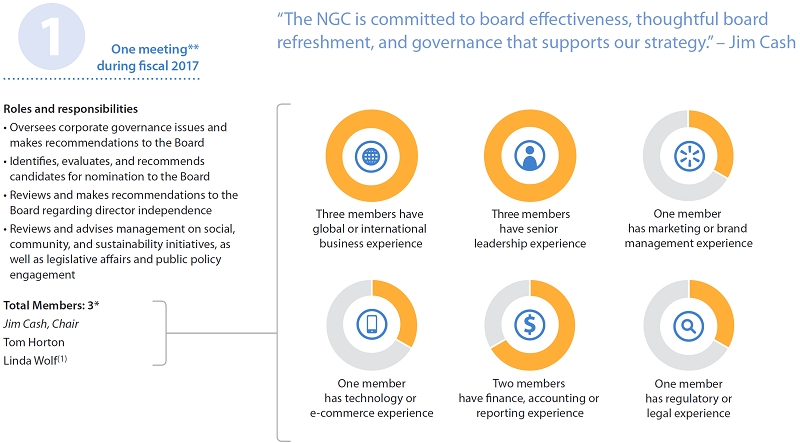

Last year, we announced that we were reducing the size of the Board while maintaining its independence. More recently, we changed the structure of our Board committees by splitting our Compensation, Nominating and Governance Committee into two separate committees: one focused on executive compensation and management development, and one focused on director nominations and corporate governance. This new structure allows greater focus on aligning our compensation and performance management programs with our strategy, as well as emphasizing our continuing commitment to board refreshment and succession planning.

To further this commitment, beginning in fiscal 2018, our independent compensation committee approved important changes to our executive compensation program to ensure that it continues to support our strategy as we transform our business. You can learn more about these changes in the CD&A on page 46.

Your Board values your feedback and thanks those of you who have participated in our ongoing and extensive shareholder engagement. The feedback from our shareholders has been consistent – they believe in our strategy, and they recognize that we have the right skills, experiences, and backgrounds on our Board to effectively guide Walmart during this exciting period of transformation.

Contents

Notice of 2020 Annual Shareholders' Meeting | | Sincerely,

Gregory B. Penner

Chairman

|

How to Attend the Virtual Shareholders’ Meeting

Virtual Shareholders’ Meeting at:www.virtualshareholdermeeting.com/WMT2020 In light of the COVID-19 outbreak, for the safety of all of our shareholders, associates, and other members of the community, our 2020 Annual Shareholders’ Meeting will be held in a virtual meeting format only with no physical location. Shareholders who held Shares as of the record date may only attend the meeting online by logging in at:www.virtualshareholdermeeting.com/WMT2020on the date and time provided in this notice. You will not be able to attend the meeting in person. The meeting will begin promptly at 10:30 a.m., Central Time on Wednesday, June 3, 2020. Please see pages 101-102 for additional information about how to access, vote, examine the list of shareholders, and submit questions during the meeting. For shareholders of record who are entitled to attend the meeting, the list of shareholders of record will be available atwww.virtualshareholdermeeting.com/WMT2020during the meeting. | | Sincerely,

Dr. James I. Cash, Jr.

Lead Independent Director

The record date for the 2020 Annual Shareholders’ Meeting is April 9, 2020. This means that you are entitled to receive notice of the meeting and vote your Shares held as of that date during the meeting if you were a shareholder of record as of the close of business on April 9, 2020.

|

Items of Business

Letter to Shareholders•Walmart | 2017 Proxy Statement 3

Notice 2017 may also transact any other business properly brought before the 2020 Annual Shareholders’ MeetingMeeting.

How Toto Cast Your Vote  (page 102)

(page 102)

(PAGE 103)

| |   | |   | |   | |   |

INTERNETInternet (before the meeting)

www.proxyvote.com | | CALLCall

| | MOBILE DEVICEMobile Device

| | IN PERSONMail

| | MAILDuring the Virtual Meeting

|

www.proxyvote.com | 1-800-690-6903 | Toll-free (U.S.and Canada) at1-800-690-6903 | | Scan the QR codeoncode on your proxy card,notice of internet availability of proxymaterials,proxy materials, or votinginstructionvoting instruction form | | at the 2017 AnnualShareholders’ Meeting | | inMail your signedproxysigned proxy card or votinginstructionvoting instruction form (if you received one) | | Please see pages 101-102 for details about how to attend and vote your Shares during the virtual meeting. |

| Items of Business | | Board

Recommendation | | Reference

Page |

| 1. | To elect as directors the 11 nominees identified in this proxy statement; | | FOR | | 12 |

| 2. | To vote on a non-binding, advisory resolution to establish the frequency of future advisory shareholder votes to approve the compensation of Walmart’s named executive officers; | | 1 YEAR | | 44 |

| 3. | To vote on a non-binding, advisory resolution to approve the compensation of Walmart’s named executive officers; | | FOR | | 45 |

| 4. | To ratify the appointment of Ernst & Young LLP as the company’s independent accountants for the fiscal year ending January 31, 2018; | | FOR | | 91 |

| 5. | To vote on the 3 shareholder proposals described in the accompanying proxy statement, if properly presented at the meeting; and | | AGAINSTeach

shareholder proposal | | 96 |

| 6. | To transact any other business properly brought before the 2017 Annual Shareholders’ Meeting. | | | | 108 |

Annual

Shareholders’

Meeting

Friday, June 2, 2017

8:00 a.m., Central time

Bud Walton Arena

University of Arkansas Campus

Fayetteville, Arkansas 72701

How to Attend the Meeting

If you plan to attend the meeting in person, please see page 102 for admission requirements.

The record date for the meeting is April 7, 2017. This means that you are entitled to receive notice of the meeting and vote your shares at the meeting if you were a shareholder of record as of the close of business on April 7, 2017.

April 20, 2017

23, 2020

By Order of the Board of Directors,

|

Jeffrey J. Gearhart

Rachel Brand |

| Executive Vice President, Global Governance, Chief Legal Officer, and Corporate Secretary |

TheThis proxy statement and our Annual Report to Shareholders for the fiscal year ended January 31, 2017,2020, are available in the “Investors” section of our corporate website athttp://stock.walmart.com/annual-reports.annual-reports

Walmart | 2017 Proxy Statement5.

| 4 |  | www.walmart.com |

Table of Contents

Contents

Walmart| 2017 Proxy Statement 7

| | | Board | | Ref. |

| Items of Business | | Recommendation | | Pages |

| 1. | To elect as directors the 11 nominees identified in this proxy statement; | | FOR | | 12 |

| 2. | To vote on a non-binding, advisory resolution to establish the frequency of future advisory shareholder votes to approve the compensation of Walmart’s named executive officers; | | 1 YEAR | | 44 |

| 3. | To vote on a non-binding, advisory resolution to approve the compensation of Walmart’s named executive officers; | | FOR | | 45 |

| 4. | To ratify the appointment of Ernst & Young LLP as the company’s independent accountants for the fiscal year ending January 31, 2018; and | | FOR | | 91 |

| 5. | To vote on the 3 shareholder proposals described in the accompanying proxy statement, if properly presented at the meeting. | | AGAINSTeach

shareholder proposal | | 96 |

In addition, shareholders may be asked to consider and vote on any other business properly brought before the meeting.

Proxy

Voting Summary

Annual Shareholders’ Meeting

Friday, June 2, 2017

8:00 a.m., Central time

Bud Walton Arena

University of Arkansas Campus

Fayetteville, Arkansas 72701

You have received these proxy materials because the Board is soliciting your proxy to vote your Shares atduring the 20172020 Annual Shareholders’ Meeting. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider in deciding how to vote your Shares, and you should read the entire proxy statement carefully before voting. Page references (“XX”) are supplied to help you find further information in this proxy statement. Please refer to the Table of Abbreviations beginning on pages 109-110page 109 for the meaning of certain terms used in this summary and the rest of this proxy statement. This proxy statement and the related proxy materials were first released to shareholders and made available on the internet on April 20, 2017.23, 2020.

If you are unable to attend in person, you can view a live webcastShareholders who held Shares as of the 2017 Annual Shareholders’ Meetingclose of business on the record date can attend the virtual meeting athttp://stock.walmart.com.www.virtualshareholdermeeting.com/WMT2020.

8Walmart | 2017 Proxy Statement• Proxy Summary

| | | | | | | |

| PROPOSAL NO. 1

Election of Directors (page 10) (page 10) | | |

| | | | | | | |

| Board Demographics | | | | | | |

| Gender 27%Female Age 53 yearsNominee Median Age Tenure ●6.6 yearsNominee Median Tenure ●12-year term limitfor Independent Directors ●More than 25%of nominees were appointed in the last 5 years | | Independence ●7 of 11 nominees are independentand 10 of 11 nominees are non-management ●All members of the Audit Committee; Compensation and Management Development Committee; and Nominating and Governance Committee are independent ●Robust Lead Independent Director role | | Highly Engaged Board ●Actively involvedin Walmart’s strategic transformation ●97% overall attendance rate atBoard and Board committee meetings ●5 Board and 24 Board committee meetings during fiscal 2020 | | |

| | | | | | | |

| | | | | | | |

| Relevant Skills and Experience

The nominees possess a balance of distinguished leadership, diverse perspectives, strategic skill sets, and professional experience relevant to our business and strategic objectives, including: | | |

| | | | | | |

| Retail Experience | | Senior Leadership Experience | | |

|  | |  | | |

| Global or International Business Experience | | Finance, Accounting, or Financial Reporting Experience | | |

|  | |  | | |

| Technology or eCommerce Experience | | Regulatory, Legal, or Risk Management Experience | | |

|  | |  | | |

| Marketing or Brand Management Experience | | Board Diversity: Gender or Racial/Ethnic Diversity | | |

|  | |  | | |

| | | | | |

| FOR |  | The Board recommends a voteFOReach director nominee | |

Table of Contents

Proxy Voting Summary

| | | |

| | PROPOSAL NO. 2

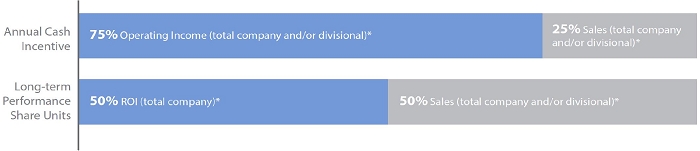

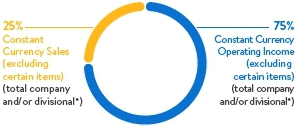

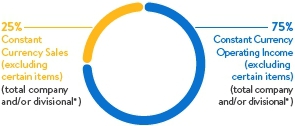

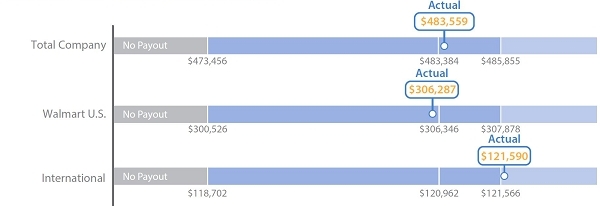

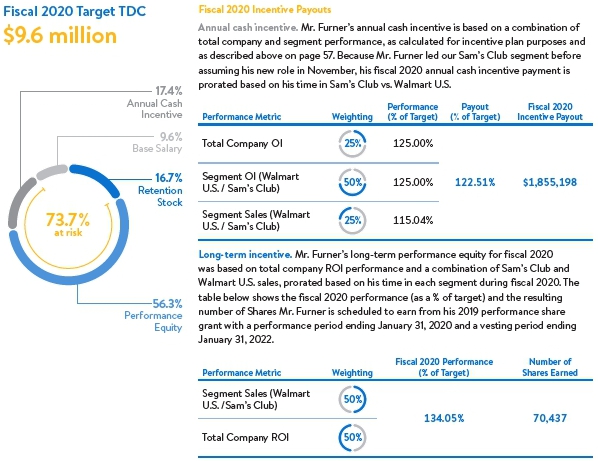

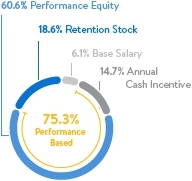

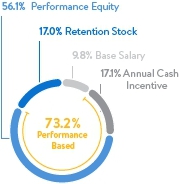

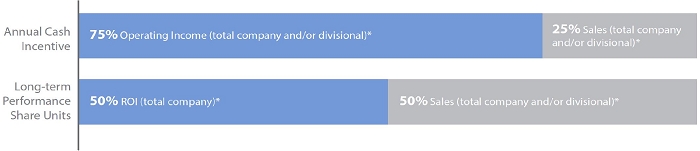

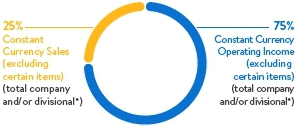

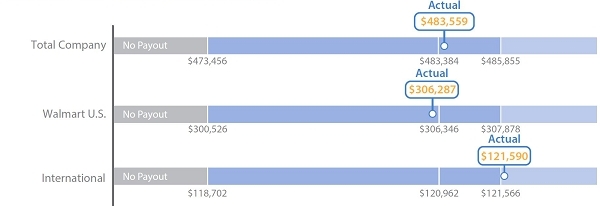

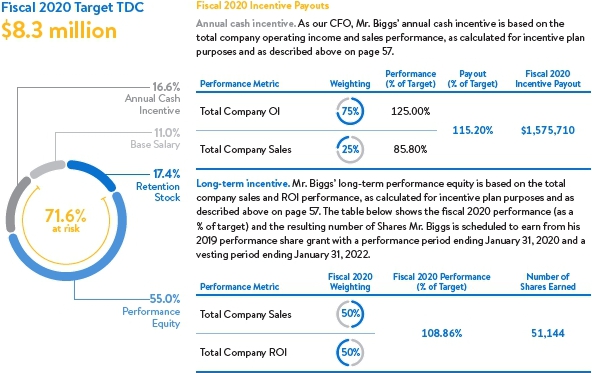

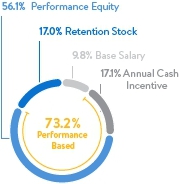

Advisory Vote to Approve Named Executive Officer Compensation (page 41) (page 41) Compensation Aligned with Performance ●Executive compensation program aligned with our strategy and heavily tied to performance ●More than 75% of our CEO’s fiscal 2020 target total direct compensation was based on achieving goals related to operating income, sales, and ROI Fiscal 2020 Total Direct Compensation (at target) | |

| |  | |

| | | |

| | FOR |  | The Board recommends a voteFORthis proposal |

| | | | |

| | PROPOSAL NO. 3

Ratification of Independent Accountants  (page 80) (page 80) Quality, Experienced Independent Audit Firm ●Ernst & Young LLP is an independent registered accounting firm with significant experience on Walmart’s audit. ●The firm’s expertise and fees are appropriate for the breadth and complexity of our company’s global operations. |

| | | | |

| | FOR |  | The Board recommends a voteFORthis proposal |

| 6 |  | www.walmart.com |

Table of Contents

PROPOSAL NO. 4

Approval of an Amendment to the ASDA Sharesave

Plan 2000 (page 85) (page 85) It has been 10 years since we last asked shareholders to approve additional Shares be available for issuance under the ASDA Sharesave Plan 2000. In order to permit ASDA to continue to grant options under this plan, we are asking our shareholders to approve an amendment that would allow for an additional 10 million Shares to be available for issuance under the plan. | |

FOR The Board recommends a voteFORthis proposal The Board recommends a voteFORthis proposal | |

PROPOSALS NO. 5-8

Shareholder Proposals, in each case, if properly

presented at the meeting (page 89) (page 89) | |

AGAINST Each shareholder proposal included in this proxy statement is followed by Walmart’s response. For the reasons set forth in Walmart’s responses, the Board recommends a vote AGAINST each shareholder proposal, if properly presented at the meeting. | |

Table of Contents

This page intentionally left blank.

Table of Contents

Table of Contents

Table of Contents

PROPOSAL NO. 1

Election of Directors

| What am I voting on?  |

| You are voting to elect each nominee named below as a director of Walmart for a one-year term. If you return your proxy, your proxy holder will vote your SharesFORthe election of each Board nominee named below unless you instruct otherwise. If the shareholders elect all the director nominees named in this proxy statement at the 2020 Annual Shareholders’ Meeting, Walmart will have 11 directors. Each director nominee named in this proxy statement has consented to act as a director of Walmart if elected. If a nominee becomes unwilling or unable to serve as a director, your proxy holder will have the authority to vote your Shares for any substitute candidate nominated by the Board, or the Board may decrease the size of the Board. |

Overview of Director Nominees and Committee Assignments Seven of our eleven Board Nominee Overviewnominees are independent, and all members of the Audit Committee, the CMDC, and the NGC are independent. Our Board has separated the roles of Chairman and CEO, and we have a robust Lead Independent Director role. Despite their significant Share ownership, only three members of the Walton family serve as non-management Board members.

| | Cesar Conde

Independent Chairman of NBCUniversal Telemundo

Enterprises and NBCUniversal

International Group Age46 |Director Since2019Other Public Company Boards1 | | | Tom Horton

Lead Independent Director Partner, Global Infrastructure Partners; and retired Chairman, American Airlines Age58 |Director Since2014Other Public Company Boards2 |

| | Tim Flynn

Independent Retired Chairman and CEO, KPMG Age63 |Director Since2012Other Public Company Boards3 | | | Marissa Mayer

Independent Co-founder, Lumi Labs Inc.; and Former President and CEO, Yahoo! Inc. Age44 |Director Since2012Other Public Company Boards0 |

| | Sarah Friar

Independent CEO, Nextdoor Inc. Age47 |Director Since2018Other Public Company Boards1 | |

Independence

| |

64% Independent |

| | Carla Harris

Independent Vice Chair, Wealth Management and Head of Multicultural Client Strategy, and Managing Director and Senior Client Advisor, Morgan Stanley Age57 |Director Since2017Other Public Company Boards0 | | Age | 53years

Board Nominee

Median Age 55years

Board Nominee

Average Age |

| 10 |  | www.walmart.com |

Table of Contents

Our Board nominees bring a variety of backgrounds, qualifications, skills and experiences that contribute to a well-rounded Board uniquely positioned to effectively guide our strategy and oversee our operations in a rapidly evolving retail industry.

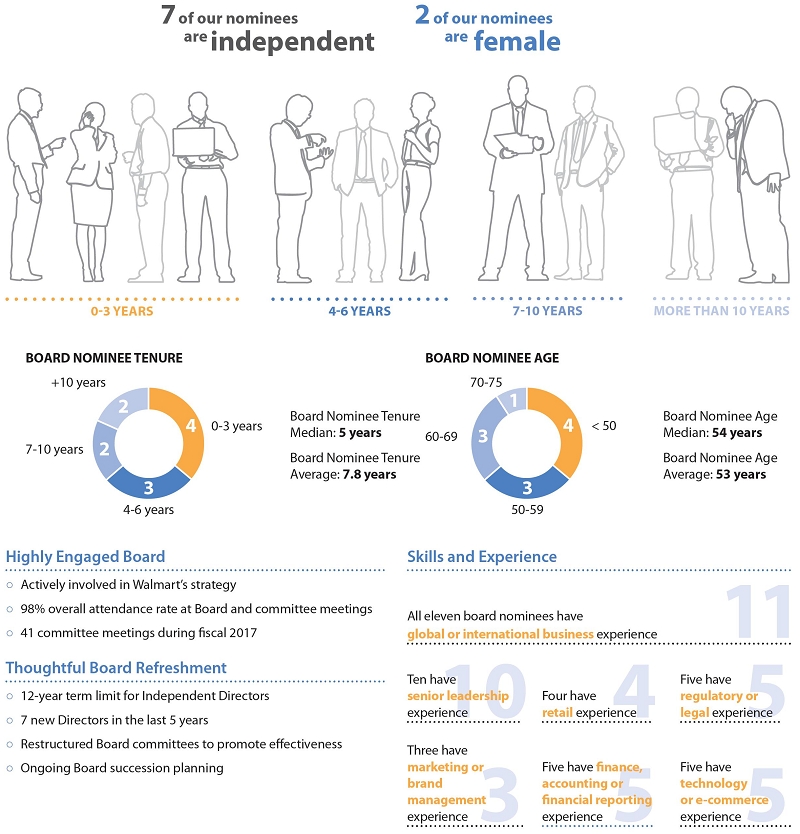

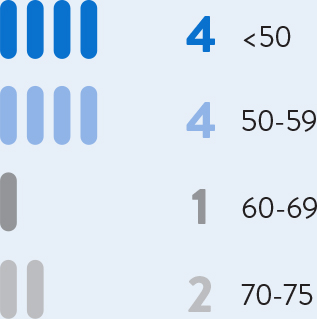

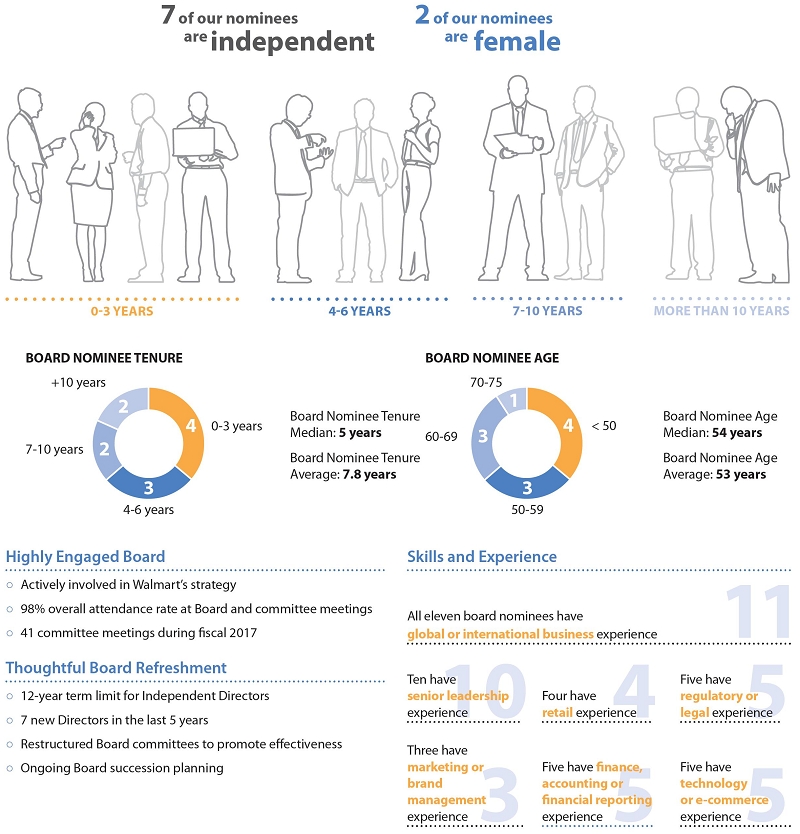

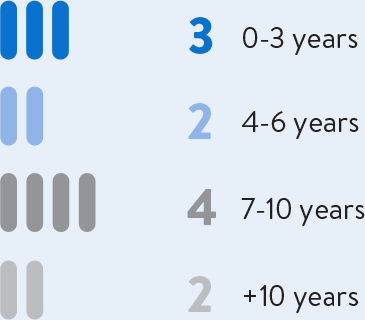

7 of our nominees are independent 2 of our nominees are female 0-3 YEARS 4-6 YEARS 7-10 YEARS MORE THAN 10 YEARS BOARD NOMINEE TENURE BOARD NOMINEE AGE +10 years 7-10 years 0-3 years 4-6 years Board Nominee Tenure Median: 5 years Board Nominee Tenure Average: 7.8 years 70-75 60-69 <50 50-59 Board Nominee Age Median: 54 years Board Nominee Age Average: 53 years Highly Engaged Board Skills and Experience Actively involved in Walmart’s strategy 98% overall attendance rate at Board and committee meetings 41 committee meetings during fiscal 2017 Thoughtful Board Refreshment 12-year term limit for Independent Directors 7 new Directors in the last 5 years Restructured Board committees to promote effectiveness Ongoing Board succession planning All eleven board nominees have global or international business experience Ten have senior leadership experience Four have retail experience Five have regulatory or legal experience Three have marketing or brand management experience Five have finance, accounting or financial reporting experience Five have technology or e-commerce experience

Proxy Summary •Walmart | 2017 Proxy Statement 9

| Highly Engaged Board | | Thoughtful Board Refreshment |

✓Actively involved in Walmart’s strategy ✓97% overall attendance rate at Board and Board committee meetings ✓24 Board committee meetings and 5 Board meetings during fiscal 2020 | | ✓12-year term limit for Independent Directors ✓More than 25% of the nominees were appointed in the last 5 years ✓Board committees structured to promote effectiveness ✓Ongoing Board succession planning |

Doug McMillon President and CEO, Walmart Age53 |Director Since2013

Other Public Company Boards0

| |

| Steve Reinemund

Independent Managing Partner, Highline Group; Retired Dean of Business, Wake Forest University; and retired Chairman and CEO, PepsiCo., Inc.Age72 |Director Since2010Other Public Company Boards3 | Our Director Nominees

7 of our 11 Board nominees are independent, all members of the Audit Committee, the CMDC, and the NGC are independent, and our key committee chairs are independent. Our Board has separated the roles of Chairman and CEO, and we have a robust Lead Independent Director role. Despite their significant Share ownership, only three members of the Walton family are Board members.

| | | | | | | | | | | | | Key Committee Membership | | Name/Age | | Experience | | Director

Since | | Principal Occupation | | Independent | | Other Pubic

Company Boards | | Audit | | Compensation

& Management

Development | | Nominating

& Governance | | Strategic

Planning

& Compensation | | Technology &

e-commerce | Jim Cash

(69)

Lead Independent Director | | · Senior Leadership · Global/International · Technology/e-commerce · Finance/Accounting | | 2006 | | James E. Robison Professor of Business Administration Emeritus, Harvard Business School | | l | | 1 | | l | | | |  | | | | l | Tim Flynn

(60) | | · Senior Leadership · Global/International · Finance/Accounting · Regulatory/Legal | | 2012 | | Retired Chairman and CEO, KPMG | | l | | 3 | |  | | | | | | l | | | Carla Harris

(54) | | · Senior Leadership · Global/International · Finance/Accounting · Regulatory/Legal | | Nominee | | Vice Chairman, Wealth Management, Managing Director and Senior Client Advisor, Morgan Stanley | | l | | 0 | | | | | | | | | | | Tom Horton

(55) | | · Senior Leadership · Global/International · Finance/Accounting · Regulatory/Legal | | 2014 | | Senior Advisor, Warburg Pincus LLC, and retired Chairman and CEO, AMR Corporation | | l | | 1 | | l | | | | l | | l | | | Marissa Mayer

(41) | | · Senior Leadership · Global/International · Technology/e-commerce · Marketing/Brand Management | | 2012 | | President and CEO, Yahoo! Inc. | | l | | 1 | | | | l | | | | | | l | Doug McMillon

(50) | | · Senior Leadership · Retail · Global/International · Technology/e-commerce | | 2013 | | President and CEO, Walmart | | | | 0 | | | | | | | | | | | Greg Penner

(47)

(Board Chairman) | | · Senior Leadership · Retail · Global/International · Technology/e-commerce · Finance/Accounting | | 2008 | | Chairman, Walmart and Partner, Madrone Capital Partners | | | | 0 | | | | | | | | | | | Steve Reinemund

(69) | | · Senior Leadership · Global/International · Marketing/Brand Management | | 2010 | | Retired Dean of Business, Wake Forest University, and retired Chairman and CEO, PepsiCo., Inc. | | l | | 2 | | | | l | | | |  | | | Kevin Systrom

(33) | | · Senior Leadership · Global/International · Technology/e-commerce · Marketing/Brand Management | | 2014 | | CEO and Co-Founder, Instagram | | l | | 0 | | | | l | | | | | |  | Rob Walton

(72) | | · Senior Leadership · Retail · Global/International · Regulatory/Legal | | 1978 | | Retired Chairman, Walmart | | | | 0 | | | | | | | | l | | | Steuart Walton

(35) | | · Retail · Global/International · Regulatory/Legal | | 2016 | | CEO, Game Composites, Ltd. | | | | 0 | | | | | | | | l | | |

| Chair | Greg Penner

Non-Executive Chairman General Partner, Madrone Capital Partners Age50 |Director Since2008

Other Public Company Boards0

| | | Rob Walton Retired Chairman, Walmart Age75 |Director Since1978Other Public Company Boards0 | | | Gender  | 27%

Female | | | Steuart Walton Founder and Chair, RZC Investments Age38 |Director Since2016Other Public Company Boards0 | l | Tenure  | 6.6 years

Board Nominee

Median Tenure 9.3 years

Board Nominee

Average Tenure | |  Audit Audit Compensation and Management Development Compensation and Management Development Nominating and Governance Nominating and Governance Strategic Planning and Finance Strategic Planning and Finance Technology and eCommerce Technology and eCommerce Chair Chair Member Member |

10Walmart | 2017 Proxy Statement• Proxy SummaryTable of Contents

Corporate Governance Highlights

(PAGES 21-43)

• | Majority Independent Board | | | • | Shareholder Right to Call Special Meetings | | | • | Independent Key Committee Chairs | | | • | No Poison Pill | | | • | Separate Chair and CEO | | | • | Lead Independent Director | | | • | No Supermajority Voting Requirements | | | • | Board Oversight of Political and Social Engagement | | | • | Annual Election of All Directors | | | • | Robust Board Evaluations | | | • | Majority Voting for Director Elections | | | • | Board-Level Risk Oversight | | | • | Commitment to Board Refreshment | | | • | Extensive Shareholder Engagement | | | • | Focus on Succession Planning | | | • | Board Oversight of Company Strategy | | | • | Robust Stock Ownership Guidelines | | | • | No Hedging and Restrictions on Pledging | | | • | No Employment Agreements with Executives | | | • | No Change-in-Control Provisions | | | | |

Compensation Aligned With Performance

(PAGES 48-73)

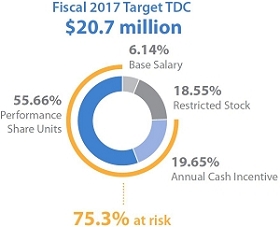

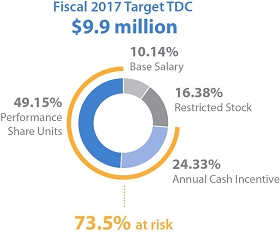

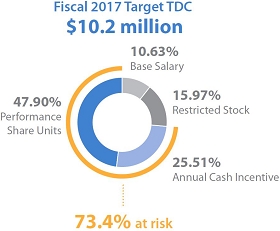

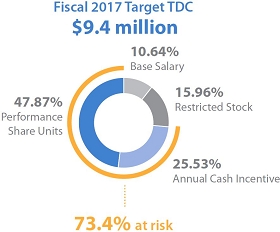

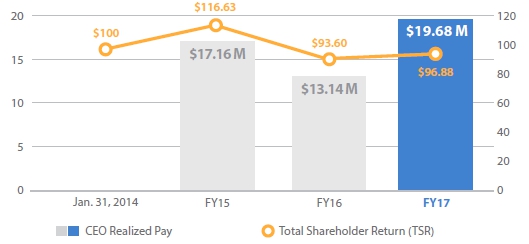

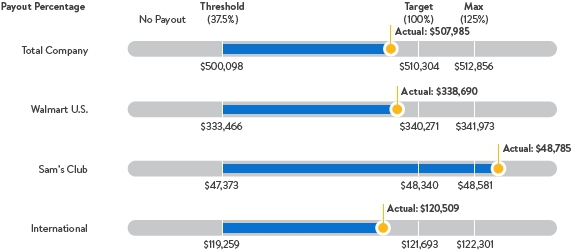

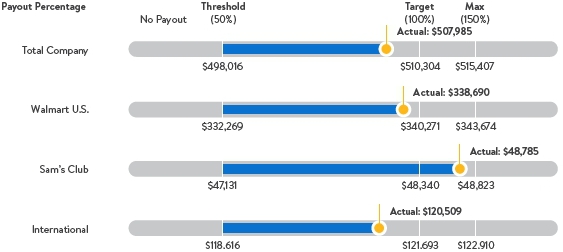

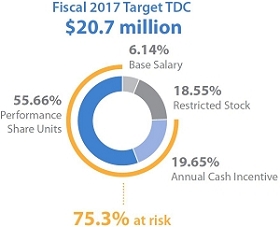

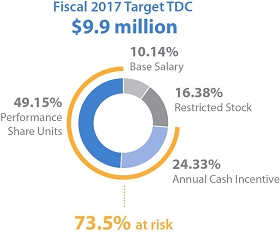

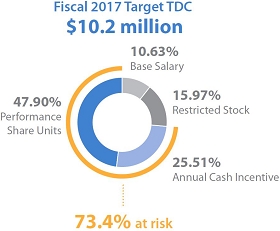

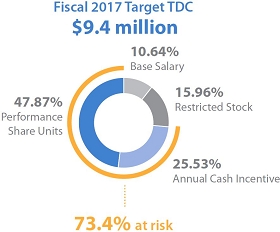

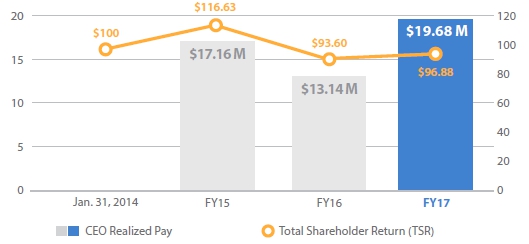

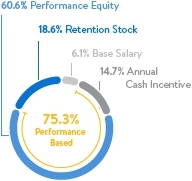

Our executive compensation program is heavily based on performance and aligned with our strategy. More than 75% of our CEO’s fiscal 2017 total direct compensation was based on metrics related to operating income, sales, and ROI, which are aligned with our strategy and important indicators of retail performance. The chart below illustrates the alignment between our CEO’s realized pay and TSR over the last three fiscal years:

CEO Realized Pay

Total Shareholder Return (TSR) CEO Realized Pay 0 5 10 15 20 $19.68 M 0 20 40 60 80 100 120 Jan. 31, 2014 FY15 FY16 FY17 $17.16 M $116.63 $93.60 $100 $96.88 $13.14 M

(1) | Realized pay includes base salary, annual incentive earned for the fiscal year shown, restricted stock vested in the fiscal year shown, and performance equity with a performance period ending during the fiscal year shown. Restricted stock and performance equity is valued using the closing price of Walmart stock on the vesting date. | | | (2) | TSR illustrates the total shareholder return on Walmart common stock during the three fiscal years ending January 31, 2017, assuming $100 was invested on the first day of fiscal 2015 and assuming reinvestment of all dividends. |

Proxy Summary •Walmart | 2017 Proxy Statement 11

Proposal No. 1 Election of Directors | Board Skills Criteria and Qualifications |

Director Skills Criteria and Qualifications

What am I voting on?

You are voting to elect each nominee named below as a director of the company for a one-year term. If you return your proxy, your proxy holder will vote your Shares FOR the election of each Board nominee named below unless you instruct otherwise. If the shareholders elect all the director nominees named in this proxy statement at the 2017 Annual Shareholders’ Meeting, Walmart will have 11 directors. Each director nominee named in this proxy statement has consented to act as a director of Walmart if elected. If a nominee becomes unwilling or unable to serve as a director, your proxy holder will have the authority to vote your Shares for any substitute candidate nominated by the Board, or the Board may decrease the size of the Board.

What qualifications do the Nominating and Governance Committee and the Board consider when selecting candidates for nomination? At Walmart, we believe an effective Board should be made up of individuals who collectively provide an appropriate balance of distinguished leadership, diverse perspectives and viewpoints, strategic skill sets, and professional experience relevant to our business and strategic objectives. The Nominating and Governance Committee (NGC)NGC selects potential candidates on the basis of:of outstanding achievement in their professional careers; broad experience and wisdom; personal and professional integrity; ability to make independent, analytical inquiries; experience and understanding of the business environment; willingness and ability to devote adequate time to Board duties; and such other experience, attributes, and skills that the NGC determines qualify candidates for service on the Board. The NGC also considers whether a potential candidate satisfies the independence and other requirements for service on the Board and its committees, as set forth in the NYSE Listed Company Rules and the SEC’s rules. Additional information regarding qualifications for service on the Board and the nomination process for director candidates is set forth in the NGC’s charter and our Corporate Governance Guidelines, which are available on the Corporate Governance page of our website athttp://stock.walmart.com.stock.walmart.com/investors/corporate-governance/governance-documents. Director Skills Criteria: Walmart is moving with speed to better serve our customers and pursue our key objectives of making every day easier for busy families, sharpening our culture and becoming a more digital, enterprise, delivering results and operating with discipline, and being the most trusted retailer.making trust a competitive advantage. Depending on the current composition of the Board and Board committees and expected future turnover on our Board, the NGC generally seeks director candidates with experience, skills, or background in one or more of the following areas: STRATEGY | | GOVERNANCE | | LEADERSHIP | | DIVERSITYExperience and Skills Relevant to the Successful Oversight of our Strategy |   | |  | |  | |  | |  | Retail | | Global/International | | Regulatory/Legal | | Senior Leadership | | Diversity | | | | | | | | | |  | |  | |  | | | | | Technology/e-commerce | | Marketing/Brand Management | | Finance/Accounting | | | | |

12Walmart | 2017 Proxy Statement•Proposal No. 1: Election of Directors

Strategy |  | | Retail Experience

As the world’s largest retailer, we seek directors who possess an understanding of financial, operational, and strategic issues facing large retail companies. | | | |   | | Global or International Business Experience

As a global organization, directorsDirectors with broad international exposure provide useful business and cultural perspectives, and as a global organization, we seek directors with experience at multinational companies or in international markets. |

LeadershipExperience and Skills Relevant to Effective Oversight and Governance |  |  | Senior Leadership Experience

Directors who have served in relevant senior leadership positions bring unique experience and perspective. We seek directors who have demonstrated expertise in governance, strategy, development, and execution. |

Governance |  | |  | Finance, Accounting, or FinancialReporting Experience

We value an understanding of finance and financial reporting processes because of the importance our company places on accurate financial reporting and robust financial controls and compliance. We also seek to have multiple directors who qualify as audit committee financial experts. |

| | |   | | Regulatory, Legal, or Risk Management Experience

Our company’s business requires compliance with a variety of regulatory requirements across a number of federal, state, and international jurisdictions. Our Board values the insights of directors who have experience advising or working at companies in regulated industries, and it benefits from the perspectives of directors with governmental, public policy, legal, and risk management experience and expertise.

|

Diversity |  |  | Board Diversity

Diversity and inclusion are values embedded in our culture and fundamental to our business. We believe that a board comprised of directors with diverse backgrounds, experiences, and perspectives and viewpoints improves the dialogue and decision-making in the board room and contributes to overall Board effectiveness. The Board assesses the effectiveness of its approach to Board diversity as part of the Board and committee evaluation process. |

| 12 |  | www.walmart.com |

Table of Contents

Proposal No. 1:1 Election of Directors•Walmart | 2017 Proxy Statement 13

Summary of Director Nominee Qualifications and Experience The chart below identifies the balance of skills and qualifications each director nominee brings to the Board. The fact that a particular skill or qualification is not designated does not mean the director nominee does not possess that particular attribute. Rather, the skills and qualifications noted below are those reviewed by the NGC and the Board in making nomination decisions and as part of the Board succession planning process. We believe the combination of the skills and qualifications shown below demonstrates how our Board is well positioned to provide strategic advice and effective oversight and strategic advice to our management. | Experience and Skills Relevant

to the Successful Oversight of

our Strategy | Experience and Skills

Relevant to Effective

Oversight and Governance | |  |  |  |  |  |  |  | | Director Nominee | Retail | Global or

International

Business | Technology or

eCommerce | Marketing

or Brand

Management | Senior

Leadership | Finance,

Accounting,

or Financial

Reporting | Regulatory,

Legal, or Risk

Management |  | Cesar Conde | |  |  |  |  | | |  | Tim Flynn | |  | | |  |  |  |  | Sarah Friar | |  |  | |  |  | |  | Carla Harris | |  | | |  |  |  |  | Tom Horton | |  | | |  |  |  |  | Marissa Mayer | |  |  |  |  | | |  | Doug McMillon |  |  |  | |  | | |  | Greg Penner |  |  |  | |  |  | |  | Steve Reinemund | |  | |  |  | | |  | Rob Walton |  |  | | |  | |  |  | Steuart Walton |  |  | | | | |  | | TOTAL | |  |  |  |  |  |  |  |

Table of Contents | | Leadership | Strategy | Governance | | |  |  |  |  |  |  |  | | | Senior Leadership | Retail | Global or

International | Technology or

e-commerce | Marketing

or Brand | Finance,

Accounting, | Regulatory or

Legal | | Director | | | Business | | Management | or Financial

Reporting | | | Jim Cash | l | | l | l | | l | | | Tim Flynn | l | | l | | | l | l | | Carla Harris | l | | l | | | l | l | | Tom Horton | l | | l | | | l | l | | Marissa Mayer | l | | l | l | l | | | | Doug McMillon | l | l | l | l | | | | | Greg Penner | l | l | l | l | | l | | | Steve Reinemund | l | | l | | l | | | | Kevin Systrom | l | | l | l | l | | | | Rob Walton | l | l | l | | | | l | | Steuart Walton | | l | l | | | | l | | TOTAL | 10 | 4 | 11 | 5 | 3 | 5 | 5 |

14Walmart | 2017 Proxy Statement•Proposal No. 1:1 Election of Directors

| Director Nominees for 2020 |

| | | | FOR |  |

| | | The Board recommends that shareholders voteFOReach of the nominees named below for election to the Board. |

Director Nominees for 2017

Who are the 20172020 director nominees? Based on the recommendation of the NGC, the Board has nominated the following candidates for election as directors at the 20172020 Annual Shareholders’ Meeting. Each nominee was previously elected by our shareholders at the 2019 Annual Shareholders’ Meeting. The information provided below includes, for each nominee, his or her age, principal occupation and employment during the past five years, the year in which he or she first became a director of Walmart, each Board committee on which he or she currently serves, whether he or she is independent, and directorships of other public companies held by each nominee during the past five years.  FORCesar Conde

| The Board recommends that shareholders voteFORIndependent Director each of the nominees named below for election to the Board. |

| James I. Cash, Jr.Age:46

Lead Independent Director

| | | | | | Joined the Board:20062019 Board Committees:

Audit

TeCC Age:69

| | Board Committees

• Audit

• Executive

• NGC (Chair)

• TeCC

| | Other Current Public

Company DirectorshipsDirectorships:

PepsiCo, Inc. |

Career Highlights |  | Chubb Limited

Since October 2015Chairman of NBCUniversal Telemundo Enterprises and NBCUniversal International Group, part of a global media and entertainment company |

| |  | October 2013 to October 2015Executive Vice President of NBCUniversal, including oversight of NBCUniversal International and NBCUniversal Digital Enterprises |

|  | 2009 to 2013President of Univision Networks, a leading American media company with a portfolio of Spanish language television networks, radio stations, and digital platforms |

|  | 2003 to 2009Variety of senior executive capacities at Univision Networks, where he is credited with transforming it into a leading global, multi-platform media brand |

|  | 2002 to 2003White House Fellow for Secretary of State Colin L. Powell from 2002–2003 |

|  | Prior to 2002Positions at StarMedia Network, the first internet company focused on Spanish- and Portuguese-speaking audiences globally |

Dr. Cash is the James E. Robison Professor of Business Administration Emeritus at Harvard Business School, where he served from July 1976 to October 2003. Dr. Cash served as the Senior Associate Dean and Chairman of HBS Publishing and Chairman of the MBA Program while on the faculty of the Harvard Business School. Dr. Cash holds an advanced degree in accounting and computer science andFurther Information

Mr. Conde has been published extensively in accounting and information technology journals. He currently provides executive development and consulting services through The Cash Catalyst, LLC, which he formed in 2009. He has served

as a director of Chubb Limited since its acquisition in January 2016 and had previously served on the board of its predecessor, The Chubb Corporation,directors of PepsiCo, Inc. since 1996. Dr. CashMarch 2016, and from August 2014 to April 2019 he served on the board of directors of Owens Corning. He also is a Trustee of the Aspen Institute and the Paley Center for Media, as well as a Full Member at the Council on Foreign Relations, and he has served as a directorYoung Global Leader for the World Economic Forum. Mr. Conde holds a B.A. with honors from Harvard University and an M.B.A. from the Wharton School at the University of a number of other public companies, including General Electric Company from April 1997 to April 2016, Phase Forward Incorporated from October 2003 to May 2009, and Microsoft Corporation from May 2001 to November 2009, and has served on the audit committees of several public companies. He also serves as a director of several private companies.

Pennsylvania.

SKILLS ANDSkills and Qualifications

QUALIFICATIONS

|  | The Board benefits from Mr. Conde’s broad experience with large media companies that produce and distributehigh-quality contentacross a range of broadcast, cable, anddigital platforms. | Dr. Cash | Mr. Conde bringsfinancial,accounting, andriskmanagementexpertise from his distinguished career valuable perspectives in academia,business, finance, and from hisleadershippositions at HBS Publishing and Harvard Business School, as well as his service on the boards of directors and audit committees of other large, multinational public companies. | | Dr. Cash brings aglobal perspectivemedia gained from his service on boards of large, multinational companiesexperience in a variety of industries.

The Board benefits from Dr. Cash’s unique knowledge ofinformation technologysenior leadership,roles at large,global media companies.

|  | With his experience at large,multi-platform mediacompanies such as well as his experiences gained from consulting activitiesNBCUniversal and service on the boards of directors of technology companies.Univision, Mr. Conde brings valuable perspective and experience regardingconsumerandmedia landscapes. |

| 14 |  | www.walmart.com |

Table of Contents Proposal No. 1:1 Election of Directors•Walmart | 2017 Proxy Statement 15  |  Timothy P. Flynn

Independent Director Age:63 Independent Director

| | | | | | Joined the Board:2012 Board Committees:

Audit (Chair)

TeCC Age:60

| | Board Committees

• Audit Committee (Chair)

• SPFC

| | Other Current Public

Company DirectorshipsDirectorships:

JPMorgan Chase & Co.

Alcoa Corporation

UnitedHealth Group Incorporated

|

Career Highlights | |  | 2007 to 2011Chairman of KPMG International (“KPMG”), a global professional services organization that provides audit, tax, and advisory services |

|  | 2005 to 2010Served as Chairman of KPMG LLP in the U.S., the largest individual member firm of KPMG |

|  | 2005 to 2008CEO of KPMG LLP |

|  | Prior to 2005Held various leadership roles at KPMG, including as Global Head of Audit, and Vice Chairman, Audit and Risk Advisory Services, with operating responsibility for Audit, Risk Advisory and Financial Advisory Services practices |

Mr. Flynn was the Chairman of KPMG International (“KPMG”), a global professional services organization that provides audit, tax, and advisory services, from 2007 until his retirement in October 2011. From 2005 until 2010, he served as Chairman and from 2005 to 2008 as CEO of KPMG LLP in the U.S., the largest individual member firm of KPMG. Prior to serving as Chairman and CEO of KPMG LLP, Mr. Flynn was Vice Chairman, Audit and Risk Advisory Services, with operating responsibility for Audit, Risk Advisory and Financial Advisory Services practices. Further Information

Mr. Flynn joined the boards of Alcoa Corporation in November 2016 and UnitedHealth Group Incorporated in January 2017. He also has

served as a member of the board of directors of JPMorgan Chase & Co. since 2012. He previously served as a member of the board of directors of The Chubb Corporation from September 2013 until its acquisition in January 2016. He has been a director of the International Integrated Reporting Council since September 2015, and healso previously served as a trustee of the Financial Accounting Standards Board, a member of the World Economic Forum’s International Business Council, and was a founding memberdirector of The Prince of Wales’the International Integrated Reporting Committee.Council. Mr. Flynn graduated from Thethe University of St. Thomas, St. Paul, Minnesota and is a member of the school’s board of trustees.

Skills and Qualifications

SKILLS AND

QUALIFICATIONS

| | Mr. Flynn has overmore than 32 years of experience inrisk management,financial services, financial reporting, and accounting. | | | |  | Mr. Flynn also brings extensive experience with issues facing complex,globalcompanies, and expertise inaccounting, auditing,risk management, andregulatoryaffairs for such companies. | | | |  | In addition, Mr. Flynn brings his experiences inexecutive leadership positions at KPMG and his service on the boards of directors of other large public companies. |

Sarah J. Friar

Independent Director Age:47 Joined the Board:2018 Board Committees:

Audit

SPFC (Chair) Other Current Public Company Directorships:

Slack Technologies, Inc. |

Career Highlights |  | December 2018 to presentCEO of Nextdoor Inc., the neighborhood hub for trusted connections and the exchange of helpful information, goods, and services |

|  | July 2012 to November 2018CFO of Square, Inc., a provider of commerce solutions, including managed payments and point-of-sale systems for businesses and mobile financial offerings for consumers |

|  | May 2011 to June 2012Senior Vice President of Finance & Strategy at Salesforce.com, Inc. |

|  | 2002 to 2012Various positions at The Goldman Sachs Group, Inc. including as a Managing Director in the Equity Research Division and other various positions where she focused on corporate finance, and mergers and acquisitions |

|  | Prior to 2002McKinsey & Company |

Further Information

Ms. Friar has served as a director of Slack Technologies, Inc., the leading channel-based messaging platform, since March 2017. She also previously served on the board of directors of New Relic, Inc., a software analytics company, from December 2013 until April 2018, and Model N, Inc. from September 2012 until May 2015. Ms. Friar is the co-founder of Ladies Who Launch, a non-profit organization focused on empowering female entrepreneurs. Ms. Friar is a Fellow of the inaugural class of the Finance Leaders Fellowship Program and a member of the Aspen Global Leadership Network. Ms. Friar graduated from the University of Oxford with a Master of Engineering in Metallurgy, Economics, and Management and also from Stanford Graduate School of Business with an M.B.A. Skills and Qualifications   | Ms. Friar bringsfinancial,accounting, andrisk managementexpertise as the former CFO of a multinational publicly-traded company and from her prior experience with a multinational investment banking firm. | | |  | The Board benefits from herleadership experience as the CEO of a large platform that connects neighbors and her prior experience as the CFO of a publicly-traded company and other various leadership positions at Square, Salesforce.com, and Goldman Sachs. | | |  | Ms. Friar brings aglobal perspective gained from her experience as the CEO of a multinational company that supports customers across a variety of businesses and industries. | | |  | The Board also benefits from Ms. Friar’s perspective regardingeCommerce andinformation technology in light of her leadership positions with digital community based platforms and a publicly-traded company that provides managed payments and point-of-sale systems for businesses and mobile financial offerings for consumers. |

Table of Contents Proposal No. 1 Election of Directors  | | Carla A. Harris Independent Nominee

| | | | | | Independent Director | | Age: 57 | Joined the Board:Nominee

Board: 2017 | Age:54 | | Board Committees :

CMDC

NGC

SPFC | • N/A | | Other Current Public

Company Directorships:

None |

Career Highlights None

|  | August 2013 to presentVice Chair, Wealth Management and Head of Multicultural Client Strategy for Morgan Stanley, a multinational investment bank and financial services company |

|  | June 2012 to presentManaging Director and Senior Client Advisor for Morgan Stanley |

|  | Since 1987Member and a leader on execution teams across mergers and acquisitions, equity capital markets and asset management, and has held a number of other positions during her tenure with Morgan Stanley |

Ms. Harris has served as the Vice Chair, Wealth Management forFurther Information

In her current roles at Morgan Stanley, since August 2013, and as Managing Director and Senior Client Advisor since June 2012. In these roles, sheMs. Harris is responsible for increasing client connectivity and penetration to enhance revenue generation across the firm. Ms. Harris joined the mergers and acquisitions team atHer prior experience with Morgan Stanley in 1987 and since then has held a number of positions during her tenure. Her experiences at Morgan Stanley range fromincludes investment banking,

equity capital markets, equity private placements, and initial public offerings in a number of industries such as technology, media, retail, telecommunications, transportation, healthcare, and biotechnology. In August 2013, President Obama appointed Ms. Harris to serve as Chair of the National Women’s Business Council. She currently serves on the boards of several non-profit organizations including St. Vincent’s HealthCare and the Morgan Stanley Foundation.

Foundation, as well as a member of the Board of Overseers for Harvard University. Ms. Harris holds a B.A. magna cum laude from Harvard University and also holds an M.B.A. from Harvard Business School.

SKILLS ANDSkills and Qualifications

QUALIFICATIONS

|  | | Ms. Harris brings broad-based and valuable insights infinance andstrategygained from more than 30 years of experience at a prominentglobal investment bankingfirm. | | | |  | The Board would benefitbenefits from Ms. Harris’ seniorleadership experienceat Morgan Stanley. | | | |  | The Board values Ms. Harris’ extensive work experience in aregulatedindustryand advising clients across a broad range of other regulated industries. |

16Walmart | 2017 Proxy Statement•Proposal No. 1: Election of Directors

| Thomas W. Horton Independent Director

| | | | | | Lead Independent Director | | Age: 58 | Joined the Board:Board: 2014 | Age:55 | | Board Committees :

Audit

Executive Committee

NGC (Chair)

SPFC | • Audit• NGC

• SPFC

| | Other Current Public

Company Directorships:

General Electric Company

EnLink Midstream, LLC |

Career Highlights QUALCOMM Incorporated

|  | April 2019 to presentPartner, Global Infrastructure Partners, a global infrastructure investment firm |

|  | October 2015 to April 2019Senior Advisor at Warburg Pincus LLC, a private equity firm focused on growth investing |

|  | December 2013 to June 2014Chairman of American Airlines Group Inc. (“American”) |

|  | 2011 to 2013Chairman and CEO of American |

|  | 2010 to 2011President of American |

|  | 2006 to 2010Executive Vice President of Finance and Planning at American |

|  | 2002 to 2005Served in various roles at AT&T Corporation, including as Vice Chairman and CFO. While at AT&T, Mr. Horton led the evaluation of strategic alternatives that ultimately led to the combination of AT&T and SBC Communications, Inc. |

|  | 1985 to 2002Served in various roles at American, including as Senior Vice President and CFO |

Mr. Horton has served as a Senior Advisor at Warburg Pincus LLC, a private equity firm focused on growth investing, since October 2015.Further Information

In August 2019, Mr. Horton was appointed to the Chairmanboard of American Airlines Group Inc. (“American”) from December 2013 to June 2014.directors of EnLink Midstream, LLC, a portfolio company of Global Infrastructure Partners that provides midstream energy services. He also served in other executive leadership positions at American, including as President from 2010 until his appointment as Chairman and CEO in 2011, during which time he led the company through a successful restructuring and turnaround that culminated in the 2013 merger with US Airways, creating the world’s largest airline. From 2006 to 2010, Mr. Horton served as Executive Vice President of Finance and Planning at American. Mr. Horton joined American

from AT&T Corporation, where he served in various roles between 2002 and 2005, including as Vice Chairman and as Chief Financial Officer. While at AT&T, Mr. Horton led the evaluation of strategic alternatives that ultimately led to the combination of AT&T and SBC Communications, Inc. Mr. Horton joined AT&T from American, where he had served in various roles from 1985 until 2002, including as Senior Vice President and Chief Financial Officer. He has served on the board of directors of General Electric Company since April 2018, where he has served as Lead Director since October 2018. From 2008 to March 2019, Mr. Horton served on the board of directors of QUALCOMM Incorporated since 2008, andIncorporated. Mr. Horton also serves on the executive board of the Cox School of Business at Southern Methodist University.

SKILLS ANDSkills and Qualifications

|  | QUALIFICATIONSMr. Horton brings unique insights gained from his

| | | |  | Our Board benefits from Mr. Horton’s leadership experience in several complex,international industries. | | |  | In addition, Mr. Horton brings valuable perspective developed from more than 30 years of experience infinance,accounting, auditing, andrisk management. |

| 16 |  | | Our Board benefits from Mr. Horton’s leadership experience in several complex,international industries. | | In addition, Mr. Horton brings unique insights gained from hisexecutive leadershiproles at large,global, publicly-traded companies.www.walmart.com |

Table of Contents Proposal No. 1 Election of Directors   | Marissa A. Mayer Independent Director

| | | | | | Independent Director | | Age: 44 | Joined the Board:Board: 2012 | Age:41 | | Board Committees :

CMDC

TeCC | • CMDC• TeCC

| | Other Current Public

Company Directorships:

None |

Career Highlights |  | March 2018 to presentCo-founder and CEO of Lumi Labs Inc., a technology incubator focused on consumer internet technologies |

|  | July 2012 to June 2017President and Chief Executive Officer and a member of the board of directors of Yahoo! Inc. (“Yahoo”) (now Altaba Inc.). At Yahoo, she led the internet giant’s push to reinvent itself for the mobile era. With a renewed focus on user experience, Ms. Mayer grew Yahoo to serve over 1 billion people worldwide - with over 600 million mobile users - and transformed its advertising approach |

Ms. Mayer is the President and Chief Executive Officer and a member of the board of directors of Yahoo! Inc. (“Yahoo”). Since joining Yahoo in July 2012, Ms. Mayer has led Yahoo’s focus as a guide to digital information discovery through search, communications, and digital content products. Ms. Mayer also helmed Yahoo’s digital advertising strategy across mobile, video, native, and social. Under her leadership, Yahoo has grown to serve over 1 billion users worldwide, with over 600 million mobile users. Prior to her role at Yahoo, Ms. Mayer spent 13 years at Google Inc. (“Google”) where she led various initiatives

including Google Search for more than a decade, and other early stage products such

| 1999 to 2012Led Google Search for more than a decade, as well as Google Maps, Gmail, and Google News. She was one of Google’s earliest employees, later moving into leadership roles as a member of their Operating Committee. | Further Information

In July 2019, Ms. Mayer joined the board of directors of Go Forward, Inc., a company that combines virtual and in-person primary care practice. Since April 2019, Ms. Mayer has served on the board of directors of Maisonette, LLC, an online company focused on providing customized shopping experiences in children’s luxury brands and boutique clothing, accessory, and home decor items. From March 2013 until October 2016, Ms. Mayer served on the board of directors for AliphCom, which operated as Jawbone. She also serves on the boards of the San Francisco Museum of Modern Art and the San Francisco Ballet, and she previously served on the foundation board for the Forum of Young Global Leaders at the World Economic Forum from 2013 to 2019. Ms. Mayer holds a bachelor’s degree in symbolic systems and a master’s degree in computer science from Stanford University. From March 2013 until October 2016, Ms. Mayer served on the board of directors for AliphCom, which operates as Jawbone. She also serves on the boards of the San Francisco Museum of Modern Art, the San Francisco Ballet, and the foundation board for the Forum of Young Global Leaders at the World Economic Forum.

SKILLS ANDSkills and Qualifications

QUALIFICATIONS

|  | | Ms. Mayer brings extensive expertise and insight into thetechnology andconsumer internetindustries, and hersenior leadership experienceexperience is demonstrated by her executive role at a prominent consumer internet company and her positions on the boards of several non-profit organizations. | | | |  | Ms. Mayer brings distinguished experience ininternet product development, engineering, andbrand managementmanagement.. | | | As |  | The Board values Ms. Mayer’s insights intoglobal businessand strategy gained from her experience as the CEO of a global company, Ms. Mayer brings insights intoglobalcompany.businessand strategy. |

Proposal No. 1: Election of Directors•Walmart | 2017 Proxy Statement 17

| C. Douglas McMillon | President and Chief Executive Officer | CEO and Director | Age: 53 | Joined the Board:Board: 2013 | 2013Age:50

| | Board Committees • :

Executive Committee (Chair)

| • GCC (Chair) | | Other Current Public

Company Directorships:

None None

| |

Career Highlights | |  | February 1, 2014 to presentPresident and CEO of Walmart |

| |  | February 2009 to January 31, 2014Executive Vice President, President and CEO, Walmart International |

| |  | August 2005 to January 2009Executive Vice President, President and CEO, Sam’s Club |

|  | Prior to 2005Mr. McMillon has held a variety of other leadership positions since joining our company more than 29 years ago |

Mr. McMillon is the President and CEO of Walmart and has served in that position since February 1, 2014. Prior to this appointment, he held numerous other positions with Walmart, including Executive Vice President, President and CEO, Walmart International, from February 1, 2009 through January 31, 2014, and Executive Vice President, President and CEO, Sam’s Club, from August 2005 through January 2009. Further Information

Mr. McMillon has held a variety of other leadership

positions since joining our company more than 25 years ago. Mr. McMillon also servesserved as a member of the executive committee of the Business Roundtable since 2014, and he became the chairman of the Business Roundtable in January 2020. He also serves as a member of the boards of directors of a number of organizations, including The Consumer Goods Forum, The US-China Business Council, and Crystal Bridges Museum of American Art.

SKILLS ANDSkills and Qualifications

QUALIFICATIONS

|  | | Mr. McMillon brings years ofexecutive leadership experienceexperience at our company and extensive expertise in corporate strategy, development, and execution. | | | |  | In addition, Mr. McMillon brings extensive knowledge and unique experience with the Walmartleading Walmart’sInternationalsegment. | | | |  | The Board benefits from Mr. McMillon’s more than 2529 years ofretail experienceand his leadership role developing and executing our enterprise strategy to deliverseamless shoppingseamlessly integrateat scale.our retail stores and eCommerce in anomni-channel offering. |

|

Table of Contents Proposal No. 1 Election of Directors

| Gregory B. Penner*Chairman

| Penner* | Non-Executive Chairman | | Age: 50 | Joined the Board:Board: 2008 | 2008Age:47

| | Board Committees • :

Executive Committee

| • GCC | | Other Current Public

Company Directorships:

None None

| | *Greg Penner is the son-in-law of Rob Walton. |

Career Highlights | |  | June 2015 to presentChairman of the Board of Walmart |

| |  | June 2014 to June 2015Vice Chairman of the Board of Walmart |

| |  | 2005 to presentGeneral Partner of Madrone Capital Partners, LLC, an investment management firm |

|  | 2002 to 2005Walmart’s Senior Vice President and CFO – Japan |

|  | 2001 to 2002Senior Vice President of Finance and Strategy for Walmart.com |

|  | Prior to 2001General Partner at Peninsula Capital, an early stage venture capital fund, and a financial analyst for Goldman, Sachs & Co. |

Further Information

Since August 2018, Mr. Penner was appointedhas served on the board of directors of a mobile premium video subscription platform that operates as Chairman of the Board in June 2015, after serving as Vice Chairman of the Board from June 2014 to June 2015. He has been a General Partner of Madrone Capital Partners, LLC, an investment management firm, since 2005. From 2002 to 2005, he served as Walmart’s Senior Vice President and CFO – Japan, and before serving in that role,Quibi. Mr. Penner was the Senior Vice President of Finance and Strategy for Walmart.com from 2001 to 2002. Prior to working for Walmart, Mr. Penner was a General Partner at Peninsula Capital, an early stage venture capital fund, and a financial analyst for Goldman, Sachs & Co. Mr. Penneralso previously served as a member of the board of directors of Baidu, Inc. from May 2004 until FebruaryDecember 2017, and he also previously served on the boardsboard of Hyatt Hotels Corporation; eHarmony, Inc.; Castleton Commodities International, LLC; 99Bill Corporation; and Cuil, Inc.

Corporation from October 2007 to September 2014.

SKILLS ANDSkills and Qualifications

QUALIFICATIONS

|  | | Mr. Penner brings expertise instrategic planning,finance, andinvestment matters, including prior experience as a CFO infor our company’s operations in Japan, and his service on the boards of directors of public and private companies in a variety of industries. | | | |  | The Board benefits from Mr. Penner’sretailexperiences with our company’s operations in Japan and at Walmart.com, as well as hisleadershipservice as our non-executive Chairman. | | | |  | In addition, Mr. Penner has broad knowledge ofinternational business, particularly in Japan and China.

| | |  | Mr. Penner brings unique expertise gained through both his service with the company and as a director of varioustechnologycompanies. |

*Greg Penner is the son-in-law of Rob Walton.

18 Walmart | 2017 Proxy Statement • Proposal No. 1: Election of Directors

| Steven S Reinemund | | | | | Independent Director | Independent Director | | | | | Age: 72 | Joined the Board:Board: 2010 | 2010Age:69

| | Board Committees :

CMDC (Chair)

NGC

TeCC | • CMDC• SPFC (Chair)

| | Other Current Public

Company Directorships :

Exxon Mobil Corporation

Marriott International, Inc.

Vertiv Holdings Co. |

Career Highlights |  | December 2019 to presentManaging Partner at Highline Group, a family office of strategic operators |

|  | June 2014 to December 2019Advisory role at Wake Forest University as Executive-in-Residence |

|  | July 2008 to June 2014Dean of Business and Professor of Leadership and Strategy at Wake Forest University |

|  | October 2006 to May 2007Chairman of the Board of PepsiCo, Inc. (“PepsiCo”) |

|  | May 2001 to October 2006Chairman and CEO of PepsiCo |

|  | 1999 to 2001President and Chief Operating Officer at PepsiCo |

|  | 1996 to 1999Chairman and CEO of Frito-Lay, Inc. (“Frito-Lay”) |

Further Information

Mr. Reinemund isserved on the retired Deanboard of Business and Professordirectors of Leadership and Strategy at Wake Forest University, a position he heldGS Acquisition Holdings Corp. from July 2008 to June 2014, and2018 until February 2020, until the completion of business combination transactions that resulted in Vertiv Holdings Co., where heMr. Reinemund continues to serve in an advisory role as an Executive-in-Residence. Prior to joiningon the facultyboard of Wake Forest University, Mr. Reinemund had a distinguished 23-year career with PepsiCo, Inc. (“PepsiCo”), where he served as Chairman of the Board from October 2006 to May 2007, and as Chairman and CEO from May 2001 to October 2006. Prior to becoming Chairman and CEO, Mr. Reinemund was PepsiCo’s President and Chief Operating Officer from 1999 to 2001 and Chairman and CEO of Frito-Lay’s worldwide operations from 1996 to 1999.directors. Mr. Reinemund has served as a director of each of Exxon Mobil Corporation and Marriott International, Inc. since 2007 and2007. Mr. Reinemund has also been on the board of directors of Chick-fil-A, Inc. since June 2015. He previously served as a director of American Express Company from 2007 to 2015 and Johnson & Johnson from 2003 to 2008. Mr. Reinemund is a member of the boards of trustees of The Cooper Institute and the U.S. Naval Academy Foundation.

SKILLS ANDSkills and Qualifications

QUALIFICATIONS

|  | | Mr. Reinemund has considerable international businessbusiness leadership experience experience gained through his service as Chairman and CEO of a global public company, through his service as dean of a prominent business school, and his | | service on the boards of several large companies in a variety of industries. | | |  | Mr. Reinemund also brings valuable experience with large,internationalbusinesses. | | | |  | In addition, Mr. Reinemund’s experience in executive leadership positions at PepsiCo and Frito-Lay provides valuable insights to our Board regardingbrand management,marketing, finance, and strategic planning. |

| 18 |  | | | | | | www.walmart.com |

Table of Contents Proposal No. 1 Election of Directors  |

Kevin Y. SystromS. Robson Walton*

| | | | | | Independent Director | | | | | | Age:75 Joined the Board:20141978 Board Committees:

SPFC

Executive Committee Age:33

| | Board Committees

• CMDC

• TeCC (Chair)

| | Other Current Public Company Directorships:

None *

Company DirectorshipsGreg Penner is the son-in-law of Rob Walton, and Steuart Walton is the nephew of Rob Walton.None

| |

Mr. Systrom is the CEO and co-founder of Instagram, where he managed the company from its founding in 2010 through a period of extremely rapid growth and through the purchase of Instagram by Facebook, Inc. in April 2012. Under his leadership as CEO, Instagram has continued its entrepreneurial development of a video sharing and direct messaging product, Instagram Direct, and has grown it to hundreds of millions of active users worldwide, making it one of the fastest growing social networks of all time. From 2006

until 2009, he was at Google Inc. and worked on large consumer products such as Gmail and Google Calendar. Before joining Google, Mr. Systrom worked with Odeo, a startup company that eventually became Twitter. He graduated from Stanford University with a bachelor of science in management science and engineering with a concentration in finance and decision analysis. While attending Stanford University, he participated in the Mayfield Fellows Program, a high-tech entrepreneurship program.Career Highlights

SKILLS AND

QUALIFICATIONS

| | Mr. Systrom provides unique insights, experiences, and expertise in developing impactful social networking and consumer internet products.

The Board benefits from Mr. Systrom’s successfulentrepreneurialleadershipin the technology and consumer internet industries.

| | In addition, Mr. Systrom brings distinguished experience in thedesign of internationally-recognized consumer internet products. | | As the CEO of a fast-growing and complex international company, Mr. Systrom brings valuable insights intoglobal business, strategy, and governance. |

Proposal No. 1: Election of Directors•Walmart | 2017 Proxy Statement 19

| 1969 to presentMr. Walton was the Chairman of Walmart from 1992 to June 2015 and has been a member of the Board since 1978. Prior to becoming Chairman, he had been an officer at our company since 1969 and held a variety of positions during his service, including Senior Vice President, Corporate Secretary, General Counsel, and Vice Chairman |

| S. Robson Walton* | |  | | | | JoinedPrior to 1969Partner with the Board:1978

Age:72

| | Board Committees

•SPFC

•Executive Committee

•GCC

| | Other Current Public

Company Directorshipslaw firm of Conner & Winters in Tulsa, Oklahoma

None

| |

Mr. Walton was the Chairman of Walmart from 1992 to June 2015 and has been a member of the Board since 1978. Prior to becoming Chairman, he had been an officer at our company since 1969 and held a variety of positions during his service, including Senior Vice President, Corporate Secretary, General Counsel, and Vice Chairman. Before joining Walmart, Mr. Walton was in private law practice as a

partner with the law firm of Conner & Winters in Tulsa, Oklahoma. Further Information

In addition to his duties at Walmart, Mr. Walton is involved with a number of non-profit and educational organizations, including Conservation International, where he servespreviously served as Chairman of that organization’s executive committee, and the College of Wooster, where he is an Emeritus Life Trustee for the college. Mr. Walton is also an Emeritus Trustee for the African Parks Foundation, U.S.

Skills and Qualifications

SKILLS AND

QUALIFICATIONS

| | Mr. Walton brings decades ofleadership experiencewith Walmart and his expertise in strategic planning gained through his service on the boards and other governing bodies of non-profit organizations. | | | |  | Mr. Walton has extensivelegal,risk management, andcorporate governanceexpertise gained as Walmart’s Chairman, Corporate Secretary, and General Counsel and as an attorney in private practice. | | | |  | The Board benefits from Mr. Walton’s in-depth knowledge of our company, its history and theglobal retail industry, all gained through more than 3540 years of service on the Board and more than 20 years of service as our company’s Chairman. |

*Greg Penner is the son-in-law of Rob Walton, and Steuart Walton is the nephew of Rob Walton.

|

Steuart L. Walton* | | | | | |

DirectorAge:38 Joined the Board:2016 Board Committee:

TeCC (Chair) Age:35

| | Board Committee

• SPFC

| | Other Current Public Company Directorships:

None *

Company DirectorshipsSteuart Walton is the nephew of Rob Walton. |

Career Highlights |  | May 2016 to PresentFounder and Chairman of RZC Investments, LLC, an investment business |

|  | None

February 2013 to November 2017Founder of Game Composites, Ltd., a company that manufactures carbon fiber aircraft and aircraft parts. He served as the CEO of Game Composites from its founding until November 2017 |

| |  | June 2011 to January 2013Senior Director, International Mergers and Acquisitions, Walmart International division |

|  | 2007 to 2010Associate at Allen & Overy, LLP in London, where he advised companies on securities offerings |

Since February 2013, Mr. Walton has been the CEO and founder of Game Composites, Ltd., a company that designs and builds small composite aircraft. Before founding Game Composites, from June 2011 to January 2013, Mr. Walton worked in our company’s International division as a Senior Director, International Mergers and Acquisitions. Prior to his service at our company, he was an associate at Allen & Overy, LLP in London from 2007 to 2010, where

he advised companies on securities offerings. Further Information

Mr. Walton is also a member of the boards of directors of Flipkart Private Limited, Rapha Racing Limited, Crystal Bridges Museum of American Art, Leadership for Educational Equity,and the Smithsonian National Air and Space Museum, and the Walton Family Foundation.Museum. He is a graduate of Georgetown University Law Center, and he holds a bachelor’s degree in business administration from the University of Colorado, Boulder.

Skills and Qualifications

SKILLS AND

QUALIFICATIONS

| | Mr. Walton brings broad-based and valuable internationallegal andregulatoryexperience gained from his work on complex,internationalfinancial transactions. | | | |  | Mr. Walton has a strong history and familiarity with our company and itsretail operationsandglobal businesses.businesses. He also brings valuable | | leadership and financial insights gained from his entrepreneurial experiences and investments. |

Table of Contents *Steuart Walton is the nephew of Rob Walton.

20 Walmart | 2017 Proxy Statement•Proposal No. 1:1 Election of Directors

| Board Refreshment and Succession Planning |

The NGC is responsible for identifying and evaluating potential director candidates, for reviewing the composition of the Board and Board committees, and for making recommendations to the full Board on these matters. Throughout the year, the NGC actively engages in Board succession planning, taking into account the following considerations: | ● | Input from Board discussions and from the Board and Board committee evaluation processregarding the specific backgrounds, skills, and experiences that would contribute to overall Board and Board committee effectiveness; and | | ● | The future needs of the Board and Board committeesin light of the Board’s tenure policies, Walmart’s long-term strategy, and the skills and qualifications of directors who are expected to retire in the future. |

| 1 | | Director Tenure Policies | | Allow Board to anticipate future Board turnover |  | The Board believes that a mix of longer-tenured directors and newer directors with fresh perspectives contributes to an effective Board. In order to promote thoughtful Board refreshment, the Board has adopted the following retirement policies for Independent Directors, as set forth in Walmart’s Corporate Governance Guidelines: Term Limit:Independent Directors are expected to commit to at least six years of service and may not serve for more than 12 years. Retirement Age:Unless they have not yet completed their initial six-year commitment, Independent Directors may not stand for re-election after age 75. | | | 2 | | Board/Committee Evaluations | | Identify skill sets that would enhance Board effectiveness | | | 3 | | Director Recruitment | | Identify top director talent with desired background and skill sets | | | 4 | | Director Onboarding | | Tailored onboarding enables new directors to learn our business and contribute quickly | |